Learn about the differences between storing digital assets on a custodial exchange wallet versus a non-custodial wallet.

Wondering what the best way to store your cryptocurrencies is? Read on for a simple explanation and comparison of two of the most popular ways to store crypto.

A Few Terms You Should Know First

Private Key: A secret sequence of random digits tied to a fund balance for a particular cryptocurrency. This key is used to manage the fund and should only be known by the owner of said funds. Whoever knows this key has access to the funds associated with it.

Custodial Wallet: The funds in this wallet are secured by a custodian. This custodian could be an exchange or any other service that holds funds on your behalf. Private keys are held by the custodian.

Non-Custodial Wallet: Funds in non-custodial wallets are secured by no one but yourself. Only you know and have access to your private key. Non-custodial wallets are also referred to as decentralized wallets.

Storing Crypto on an Exchange

Exchanges operate custodial wallets. They manage your private keys for you while you have your funds stored in your exchange wallet. This is convenient if you are trading on the exchange regularly.

However, it comes with serious risks:

Exchanges are prone to hacks, and a quick internet search can pull up crypto exchanges around the world that have suffered this fate.

Inexperienced Crypto Investors

Some in this demographic opt to store on an exchange since all they require is an account and a password. They do it because it’s similar to services used in the non-crypto world.

However, storing on an exchange is not recommended for long-term storage due to the security risks.

Why are exchanges prone to hacks? Exchanges are public platforms that anyone can access. Malicious actors know that large volumes of funds are stored on the exchange, which acts as an incentive for them to find vulnerabilities to exploit.

When to Store on an Exchange?

Exchanges should only be used for short-term storage. This option makes sense if you’re an active trader. But even if you’re a day trader, you should transfer your funds out of the exchanges at the end of your trading day to ensure overnight safety.

Storing Crypto in a Decentralized Wallet

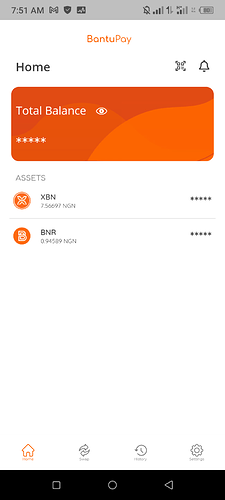

Decentralized (or non-custodial) wallets exist as apps or physical devices that provide complete control over funds to their users.

To secure your funds in this type of wallet, go into the ‘Settings’ to view your private key and write it down on a piece of paper. Store this paper somewhere only you can access it.

Unlike exchanges, non-custodial wallets are substantially less prone to hacking attempts. In fact, there are only a few ways you could lose your funds through this wallet.

Risks for a Non-Custodial Wallet

- You forget or lose your private key

- Someone else accesses your private key

Storing a private key digitally further exposes it to malware risks, so write it down physically. Keep it somewhere safe, like a safe or a locked cabinet. Doing this will prevent the first risk completely.

Regarding the second risk, it can happen in only two ways:

- Someone uses malware to access your private key

- Someone physically views your private key

If you don’t store your private key digitally, the first risk is less likely, but it could still happen. In order to prevent this be cautious of your online activities.

You cannot control if an exchange gets hacked or not, but you can control the risks with a non-custodial wallet. Hence, it’s more secure than storing funds on an exchange.

You should only store your funds on an exchange, or any other type of custodial wallet, if it is more convenient or economical to do so for your daily activities on that platform.

Regardless, you should transfer your funds to a non-custodial wallet for overnight storage.

The Security of Private Keys

Unlike traditional services that involve creating an account and setting a password, private keys are much more robust.

With a private key, you could lose the phone or computer that has your crypto wallet in it, but as long as you have your private key, you can access your wallet with the same funds from the previous device.

Also, without access to your private key, a hacker only has the option of a Brute force attack to hack your wallet. This attack involves using computers to guess the key.

The cryptography of private keys involves a range of possible keys so large that even a computer finds it infeasible to attempt to guess a single key.

Most non-custodial wallets like Bantupay wallet don’t expect you to store your private keys directly. Instead, you write down or memorize a human-friendly sequence of 12–24 random words. This sequence is known as the seed phrase and it can be used to derive multiple private keys, one for each asset you own.